Find your ideal asset allocation

The asset allocation you are most comfortable with will depend on many factors, including your investment time horizon (the length of time you expect to remain invested before starting to take withdrawals from your account) and your appetite for risk.

For example, an asset allocation heavy on stock funds may provide the potential for higher long-term returns (because stocks historically have higher returns than bonds over time) but may also present more risk in the short term (because stock values are often more volatile than bonds). This type of “aggressive” asset allocation may be appropriate for someone with a longer time horizon who is willing to ride out short-term ups and downs for the opportunity to potentially generate more long-term growth.

Stay in your investment mix comfort zone

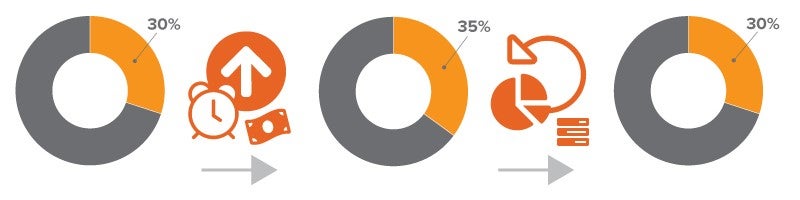

Over time, the individual funds in your portfolio will perform differently from one another. If certain funds rise in value while others decline in value, your asset allocation is going to shift. Let’s say you put 30% of your savings into a growth fund. After a year or two of stellar performance, your growth fund has grown. That’s great! But now it accounts for 35% of your savings. You might be okay with that change, or you might decide that you’d be more comfortable keeping that fund closer to your original 30% target.

You could move some money out of your growth fund and directly into another fund that hasn’t been performing quite as well by requesting a fund-to-fund transfer. This can help you “balance things out” and keep your preferred asset allocation—and overall portfolio risk level— closer to your comfort zone.

If the markets (and many of your individual funds) have changed in value dramatically, you have the option to make across-the-board adjustments by rebalancing your entire portfolio to maintain your ideal asset allocation. A fund-to-fund transfer is more of a fine-tuning tool, enabling you to rebalance one fund relative to another fund without selling and buying units across all of your funds.

Focus on the long-term

Your retirement account is a long-term investment vehicle. Depending on your age today and expected retirement age, your investment time horizon could be twenty to forty years or longer. Even after you retire, you’ll keep most of your assets invested (likely with a more conservative asset allocation to reduce risk) which adds even more years. With that kind of time frame, it may not be necessary to constantly transfer your savings from fund-to-fund in an effort to keep up with short-term fluctuations in the markets. But when you do feel the need to make specific changes to your investment strategy, a fund-to-fund transfer can help you keep your portfolio’s asset allocation right where you want it.

While using diversification and/or asset allocation as part of your investment strategy neither assures nor guarantees better performance and cannot protect against loss in declining markets, they are well-recognized risk management strategies.